Archives Page

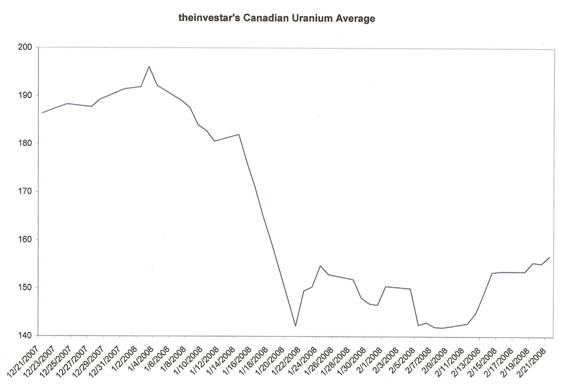

Uranium Index Continues its Rise Over the past week we have seen theinvestar's Canadian Uranium Average creep through some recent highs and establish itself on a potentially new trend upwards. We must note that this trend would have been much more profound had Uranium One not dragged down the average so much with their recent disappointing news, however such is life and we just wanted to alert everyone as to the “real” general strength among the industry as a whole. We see Pinetree Capital, a company which holds large stakes in many of the uranium juniors moving strongly higher with other large caps including Denison Mines Ltd., Mega Uranium (a company in which PNP owns a large stake), Aurora Energy and Laramide Resources. Investors have even pushed up the shares in Uranium Participation Corp. over the past few days which could be in anticipation of a rally in the uranium spot price with power problems in South Africa appearing to be a long-term issue and not possessing a quick fix.

It appears that uranium miners may be breaking out of the past year's downtrend and moving higher. In the past month we have held against the year's lows and moved strongly higher- the across the board strength is not justified by the above chart as Uranium One has been down roughly 30% in the past week and it is one of the 5 largest companies in the index. Our belief is that all precious metals will continue to rise as power will continue to be an issue in South Africa. Although this has little to do with uranium on the surface, it has two very important issues that could potentially affect uranium firms. First, and most importantly, South Africa is the largest producer of electricity on the African continent and export electricity to many of their poorer neighbors. This affects the uranium companies in countries such as Namibia for instance who will probably not be able to increase production due to an inability to increase power consumption from the Namibian power grid. The good news is that Namibia has plans to build both power plants and desalinization plants in order to increase the output of current mines in the country and enable companies to bring new ones online. The second issue affecting uranium companies in the region, and this is on a much smaller scale, is the fact that some of the mines in the region host gold along with uranium, with gold as the by-product. As gold prices rise, the companies realize a “kicker” in that they are already paying to extract the resources. So as prices rise, earnings rise exponentially. Also of interest to many of you has to be the fact that oil has now risen above the $100 price level on real trades. Previously there were a two floor trades of one contract each where the traders priced the contracts at $100 for the sake of it and the market ignored it as they were set up. This week however, we saw real trades push the price above the century mark and real closes above it as well. Following oil higher is natural gas which has recently risen to multi-year highs and could break out further if oil continues its steady rise in the next few months. Not only are oil and natural gas rising, but coal has risen as well, which seems to complete the trifecta. Coal is up on China's plans to add electricity capacity derived from its use, which we highlighted in our last article, but as coal's price rises so too does the attractiveness of natural gas fired plants which are much more cleaner burning than coal plants. With all of this said, one has to believe that uranium prices can go higher, especially as it becomes more and more price competitive with coal and gas fired turbine plants. Investors in Uranium Participation Corp. are indicating as much as they push the price up. The bull case for uranium still remains that supply is constrained, and the future production we believed we would be having in the next few years is not going to make it to market as Cameco, Uranium One and Paladin have dropped production estimates over the past year. Demand is still increasing as many Asian countries, along with the BRICs (the Brazil, Russia, India and China's of the world) are planning to build many new nuclear plants which will only add to the demand side currently unfulfilled by supply. In the weeks ahead geopolitical events should play a key role in where energy prices go from current levels and thus should be given proper attention. We think that uranium mining shares will continue to rise in the weeks ahead, and should 2008 become the year of commodities then we could see movement upwards over the next few months. We will be adding RSS feeds in the next few weeks to the

site, so if you would like to receive our daily news on the uranium mining

industry, potash mining industry, or our articles, feel free to sign up by

clicking the 'Contact Us' link below.

© theinvestar.com, LLC - read disclaimer

|

|