Archives Page

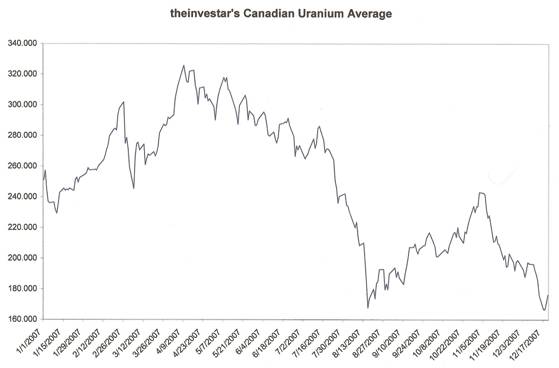

Uranium Investors Returning from Hibernation? In the past week uranium equities continued their march downwards towards this year's lows. In fact, they even set a new yearly closing low in Tuesday's trading as indicated by our Canadian uranium index. Trading sessions on Wednesday and Thursday provided a bump upwards for uranium stocks which is what we would have expected and is quite healthy. In our experience this does not necessarily indicate that the bottom has occurred, however it does indicate that at these prices there are traders out there willing to take on the risk/reward situation the market is offering them. It does not solve all of our problems at this point, but it is certainly a step in the right direction.

Also, Tradetech announced that uranium spot prices had fallen $3 to $90 as a result of miners needing to sell their material for cash flow purposes. Although uranium metal is still performing strongly, uranium stocks, as before mentioned, are fairing poorly. Something will have to give soon as China continues to announce further building plans for nuclear plants to power its growing energy needs. Most likely the price of uranium metal will continue higher as the supply demand situation continues to favor miners over utilities with miners being the beneficiary. Uranium mining stocks will undoubtedly move higher once it is realized that the bubble has not popped, and that there is indeed a future for some of these companies. After all, even though supply has grown in the past few years as projects have come online in Africa, Asia and the United States (re-opened past producing mines), demand is increasing as well with each new nuclear plant built. At this point, buying uranium equities which own uranium deposits or better yet producing mines would probably be best. As we have said before it is our experience that the quality leaders nearly always lead the pack out of rough patches and then the market performs the “trickle down effect” and the riskier equities begin their rebound. Now it might seem that we here at theinvestar.com are simply uranium bulls and would not have it any other way, but when you look back at all the events of the past 12 months, nothing has really changed...except of course the value of many portfolios. The majority of investors in the world have had their portfolios hit in the mortgage paper fiasco of 2007. The story surrounding uranium though has not changed, there still is not enough mined uranium to supply the world's uranium demand and many of today's mines face production hurdles, be they rebel groups, flooding, lack of infrastructure and NIMBY/regulatory issues. This is not a problem which will be solved overnight, and in fact it appears that bringing more supply online gets harder on a daily basis. Governments from Russia to Mongolia to many found in Africa seem to be trying to take more control over deposits and are in fact delaying projects with the uncertainty they are creating. Laramide (LAM.to) is a perfect example of the leadership we are talking about. In the graph displayed below, you can see how it snaps back at the end of the chart. Now this is by no means a slam dunk to continue, but it is along the lines of our thesis.

Laramide fell on heavy volume, and began its correction on regular volume, possibly an indication of capitulation? Pinetree Capital also seems to support our thesis and has risen significantly since December 17. Although not a pure play uranium company, we view this company as a barometer for all things uranium due to their vast holdings in uranium exploration companies.

Just like Laramide, Pinetree has seen its stock rise on ordinary volume after falling on above average. Possibly a trend here. This was an industry wide bounce we experienced over this week and it is indicated best in the riskiest of the issues on the market today. Western Prospector and Khan Resources have been facing governmental hostilities in Mongolia and have seen their market-caps cut significantly in the past quarter. These stocks were hit hardest on in the past few weeks, however in this snap-back we have all experienced they have been among the strongest performers. Both up nearly 20% on Thursday alone, this is an indication of the risk appetite among investors willing to participate in the uranium marketplace. These will not be the stocks to lead us out initially, however if this is the correction we have been looking for (upwards correction that is) they will not perform poorly in the next few months unless the situation in Mongolia continues to deteriorate.

These one month charts display the breakdown in investor risk tolerance for uranium explorers in this correction. Both companies potentially face ownership issues with the Mongolian government, but both have significant deposits on their respective properties. Investors seem to have discovered a favorable risk/reward ratio in the last two trading sessions. Now the final reason we are still believers in this uranium bull market is the very fact that other investors are still pro-actively partaking in the marketplace. One of our favorite barometers to measure the market by is the measurement of new capital entering the market, and quite honestly we were worried about this for the past few weeks. For now all appears fine in the uranium arena with a number of companies finding success in raising funds through private placements. The most ambitious plan is one where Nu-Mex Uranium Corp. and NWT Uranium Corp. plan to sell at least $10 million in stock by way of private offering to be completed in tandem with their proposed merger. The merger hinges on the completion of this offering by Nu-Mex, but at this point it seems that the deal will be completed as NWT recently spurned another offer from a third party, which we are told was Azimut Exploration, in order to continue with the planned merger with Nu-Mex. On Monday (December 17) Santoy Resources indicated that they had completed a private placement for over C$5.5 million. So long as the capital markets are open to the uranium

explorers, then the drills will keep turning and news flow will continue. Many

companies can still be bought at what we believe are option prices, that is many

of the stocks trade at prices resembling call option pricing but with a period

of perpetuity. Once again we find ourselves buyers of all things uranium.

© theinvestar.com, LLC - read disclaimer

|

|