Archives Page

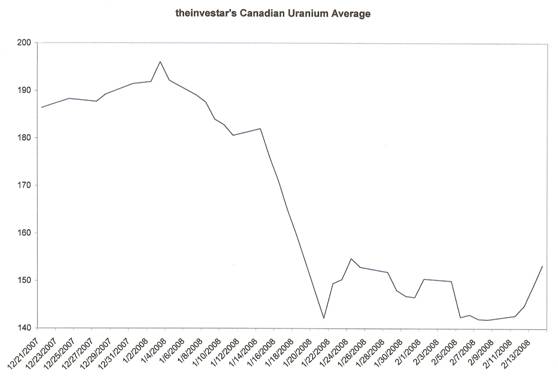

Uranium Index on the Rise The past nine months have been very rough for investors in uranium equities, and our long-term chart for theinvestar's Canadian Uranium Average fully supports this statement, but it appears as though the industry has bottomed and is now on its way up. Our index fell all the way down to 141.87 on February 8, 2008 from a high of 325.915 on August 9, 2007 and the losses were across the board with only a few winners in that time-frame. As you can see by the chart below, it appears that in the past week we tested lows set in late January, pretty much held those levels with minimum further movement to the downside. Now uranium equities are moving upwards to test the recent high set on January 24 of this year. If we can get through that level we can move much further as momentum is currently on our side with Cameco recently being upgraded and all things considered a commodity are moving strongly upwards.

We continue to like the new producers, such as Uranium One, Denison Mines and Paladin as well as those who will be bringing projects online in the near future including, but not limited to, UR-Energy, Uranerz Energy and Strathmore Minerals. The newest producers are able to get the highest prices in the industry for their uranium output and they have some of the most favorable terms in the industry in their supply contracts. These newest producers are able to effectively sell their output at almost triple the price, on average, that their larger brethren are able to get due to the latter's legacy contracts. So although the spot price has declined by nearly 50%, the companies making the most from their output are the new producers. One important note is the fact that Cameco, Energy Resources of Australia and the like will be able to increase profits each year just by signing new contracts which expire (however they need to keep production at current levels to reap the benefits from their rising contract prices which neither CCJ or ERA have been able to do for various reasons). The companies bringing projects online in the next two years excite us due to the fact that they get to create these favorable supply contracts with the utilities while prices are good and beat everyone to the market before the supply/demand ration begins to deteriorate (which should occur around 2012-2015 when many projects are expected to come online). We suspect that many of the end users are waiting until this period to make their large purchases and are just trying to tread water at this time in order to make it until prices are lower, however if the current building spree of nuclear power plants continues then the shortage of uranium could last many years longer. For those who missed it, The Wall Street Journal ran an article on the front page discussing China and their need to build new coal plants to meet their power demands recently. For those who miss the irony here, let us explain the significance for you. First they have a pollution problem which is out of control and coal certainly is not going to alleviate the problem. Second, they are merely building power capacity to meet today's (not literally, but their present needs-meaning what they see is needed for the coming 18 months or so) needs and not taking into account the fact that they are going to need exponentially more power the more they modernize. The higher their quality of life rises, the more power each individual uses and one must not forget that China is modernizing the whole country so not only is the quality of life going up for the individual, but more and more people's lives are improving as the country builds new housing for old neighborhoods and cities. In short their current modernized population is still experiencing growth in their quality of life while at the same time their building spree and increased employment is increasing the pool of their modernized population! The only way to meet their future needs for power (that is without having to have a coal power plant in each neighborhood!) will be to increase their already ambitious building plans for nuclear power plants. It is important to realize that each of these plants will require a fixed amount of uranium each year, and even more important is the fact that in their first year they will require even more uranium due to the fact that it requires more to fire up the reactor for the first time, plus the need to build an initial stockpile. We can picture this as being a multi-generational movement as it takes years to build nuclear power plants in the Western world and there really is no end in sight for power consumption with today's Digital Age running full steam. The current environment seems to favor those will a will

and a want to hold these securities for a few years out as there seems to be

good news in the pipeline. After all, why in the world would China and Japan be

so interested in signing all of these uranium exploration deals if they were not

seriously interested in creating large nuclear industries in Asia? We should

know by Monday whether we have gotten above our resistance level in the index so

as to move higher across the board. Until then, good luck and happy investing.

© theinvestar.com, LLC - read disclaimer

|

|