Archives Page

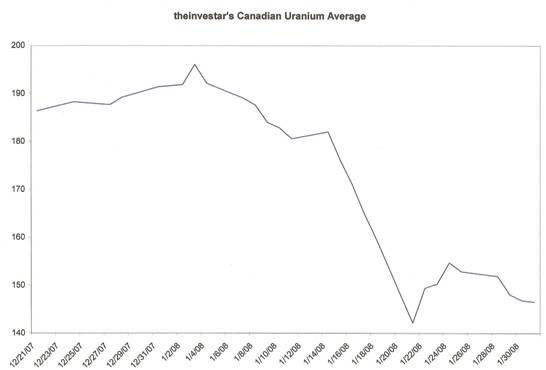

Bottoming Out? After the Fed meeting this week which took place over a two day period (Tuesday and Wednesday) we received the rate cut the markets wanted and needed, 50 basis points. Just as the market began to cheer and the Dow and Nasdaq were at session highs, financial fears re-entered the market and spooked markets all the way down to session lows. It seems that those fears may have been a bit overblown now that it is apparent that Wall Street banks are preparing to make some rather large investments in the bond insurers to save their own backs. With that said, it is no surprise that there has not been further fallout from the financial mess we currently find the markets in. In our last article we highlighted how financial equities and uranium equities were mirroring each other in their trading. Many probably realize that many financial stocks have greatly appreciated in value in the past month or so, with the largest gains coming in those stocks most leveraged to perceived poor businesses or business practices. It appears that investors' risk appetite for the financial sector is returning, and thus believe that a “tickle down effect” may be possible with uranium equities. We have noticed many of the uranium equities setting lows in the past few weeks and subsequently bouncing back to life shortly after. This is indeed the case with our uranium index as it fell through previous lows (and very strong support levels, to plummet to all-time lows over 10% lower. For the time being we believe that a new support level has been found across the board and that barring any new bad news out of the financial sector that it is simply a matter of time before uranium equities begin to creep back up. The spot price could be the catalyst for a move upwards should it climb in the next few weeks with the news of power being rationed in Africa.

Our current watch list includes many of the near term producers as we have indicated over the past few months, but we are very interested with Uranium One. Uranium One, the former SXRuraniumone, is a geographically diversified company with assets on four different continents and by the end of the year could have operating mines on three of those continents, possibly even four. This greatly reduces their risk in regards to their current mines in Africa and Asia as they would have Western governments backing them in Australia and the USA. One can also believe that UR-Energy will have a mine by the end of the year or in a worst case scenario sometime early next year (best case has them with two mines by the close of 2009 last we checked). URE is an ISR focused company with assets in the state of Wyoming, and we hear that they are addressing the mill issue right now and have a few ideas that they are moving forward with. The company has a stable of intriguing properties in both the US and some grassroots exploration projects in Canada. We are impressed even more by the management team in place and believe that the company may possess the top ISR team in the world and should be a huge asset as the company progresses towards bringing their first projects online. Strathmore is a company we have liked for many years now but still find ourselves liking the story. They have kept the float low while moving forward with bringing key projects online. Their first mine will be opened in 2009 (best case scenario once again) with their best projects coming online in the years after. With over one pound of uranium per share in the ground we believe that the company could see a price rise above the market average when markets once again favor uranium equities. The company has plenty of cash, equity positions in numerous uranium explorers, and much of their exploration budget funded by their joint venture partners. In the next few years the company should increase the stock price by using others' money in bringing these properties either to production or proving up the reserves. The large Sprott (now Cormark) holding (~20%) should ensure that the company will not be forced into a cheap buyout before bringing their projects online as well as continue to provide stability to the stock price. The uranium equities have been beaten down badly over the

past 6 months, and are offering an entry point today which is about that which

one could have bought in at roughly two years ago. Great fortunes are made when

one buys as blood is in the street, and our feelings about the current market

have changed 180 degrees due to the fact the US Federal Reserve is now ahead of

the curve, and may cut another 50 basis points after the one on Wednesday. As

inflation (as denoted by today's wage decrease in the employment report

indicated) is less of a problem than previously perceived, and it is apparent

that the rate cuts have not increased the inflation rate, the Fed will be less

likely to worry about it when cutting. Hopefully with the help of the Fed and a

perceived change in the direction of financial equities, and the market in

general, uranium equities will begin to turn around and snap back in fashion.

© theinvestar.com, LLC - read disclaimer

|

|