Archives Page

Revaluing the Market Uranium equities have been relatively quiet lately, with little or no movement in their prices. Our experience over the years with dealing with the uranium juniors tells us this is probably the calm before the storm. It generally has taken one event each year to begin the bull runs, much like an avalanche starting. Many of you will probably remember last year's catalyst being Cameco's poor engineering at the Cigar Lake Mine and its subsequent flooding. This year I have absolutely no idea what will be the catalyst, however we are beginning to see the big picture as far as the future demand picture is concerned. The first application was turned in to build and operate a nuclear power plant in the United States in nearly three decades. It is expected that many more applications will begin to be filed over the next one to two years in states such as North Carolina, South Carolina, Texas and potentially Georgia as well. The more nuclear power plants that come online in the United States in the coming years, the higher the domestic demand for uranium will be (especially in the first year of electrical production as you have to fire up the reactor which uses more fuel than in later years) which should invigorate the domestic uranium explorers as well as those in Canada. We are seeing traces of the market beginning to heat up, but right now we are not sure whether it is a bounce off of our yearly lows or something much more significant. The Canadian uranium equities have kept their uptrend intact now for quite some time, and the good news is that the news flow is just now beginning to increase due to the first drilling/exploration activities carried out by the companies this year.

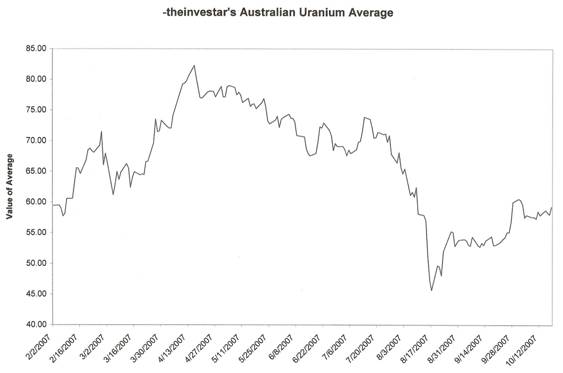

Canadian uranium equities have performed smartly since hitting their yearly lows in the middle of August. They continue their march upwards. We must admit that we are a bit amazed at the fact that investors have revalued some of these companies at their current prices. Case in point: Universal Uranium (UUL.v), which today trades at roughly the exact same price it traded before they announced the positive drill results from their 60% owned Two Time Zone located in Labrador's Central Mineral Belt. Uranium prices are down from the highs, but still up from last year when they were in the $50-60 range. We will be interested to see where this trades in the future as the company completes its NI 43-101 as well as drilling and further exploring its other projects in the CMB with its 40% joint venture partner Silver Spruce. Silver Spruce (SSE.v), it must be noted, is roughly twice the price that it was prior to announcing the results for Two Time Zone which is probably a very good indicator for what could be in the cards for Universal. There are numerous other examples available, both here in North America and Australia as well, but we believe that this case best demonstrates how ineffective the market has been in revaluing many of the uranium juniors. Canada is a bright spot, but Australia is worrying us a bit. Volume has dropped significantly on many of the stocks we follow and some of the stocks which are still trading have very little movement in their prices...some not changing for days at a time. This could be a good sign, indicating that capitulation has been hit and that at some point in the future we will see many of those Australian investors come rushing back into the uranium arena.

Although volume has dried up in Australia, their uranium equities are performing much like Canada's...up. Most would frown at this low volume accompanied by higher prices, but our belief is “up is up” and we shall stick to it. Uranium Spot Prices jumped up to $78/pound as demand returned to the spot market in a big way. Stockinterview.com reported that, “one US utility is seeking proposals to deliver 3.6 million pounds U3O8 equivalent” for the long-term market indicating that buyers may be sensing that prices are now going higher. If memory serves me correctly, many utilities withdrew from the spot and long-term markets right before hedge-funds and the DOE decided to flood the market (some of the sellers did sell, but others have yet or withdrew). Also of interest to many will be that oil has crossed into the $90 range. It did this in overnight trading, and has maintained the gains in morning trading today. Some of this is due to the fall in the US Dollar and some to the geopolitical pressures around the world. Many around the world who are being described as “experts” have said that the 500,000 barrels which are estimated to flow through Turkey via Iraq constitute less than 1% of daily output and therefore have little impact on supplies. We heard the 0.5% number thrown out as the exact percentage, and if we are to believe the other experts who say that the world currently has between 1-5% extra production to supply on any given day (which they also say is generally in the 1-2%) then that lost supply is between 10% and 50% of our cushion. One thing to watch is the margin requirements for oil at the NYMEX, for if they were to raise the requirements it could trigger a sell-off as has happened previously. We continue to see pressures on the dollar, as mortgage problems seem to be creeping back up on us. For now we are happy to be long the Canadian and Australian Dollars, but would be hesitant of being long the Euro vs. the US Dollar. The Europeans are faced with the same financial problems as the Americans, and keep in mind that they have not lowered interest rates, but have pumped money into their financial system. The European banks have problems and will need a little help to fix the balance sheets and keep credit markets liquid, especially as some of the larger institutions (Santander and RBS) have spent a lot of cash on acquisitions and will need to float bonds in the near future. China seems to be where everyone is making tons of money these days, but the Chinese government has taken steps to try and slow the unbelievable bull market taking place there right now. Soon Chinese Nationals will be allowed to purchase shares in Hong Kong (the H-shares), which trade at a steep discount to the same shares (called A shares) which trade on the mainland. We could see the first exodus of the Chinese people's investment capital abroad, which could cool the mainland's stock and real estate markets. The move could also push the Hong Kong market higher, and be the first indication of the China public's investing power. ETFs and mutual funds holding Hong Kong listed shares should probably outperform those composed of the A-listed shares (mainland China). We mentioned that news flow is picking up in the uranium

arena, and yesterday demonstrates just how desperate investors were for good

news regarding uranium equities. UEX, along with AREVA, reported the second best

hole to-date at the Anne Deposit (located South of the Carswell Structure in the

Southwestern area of the Athabasca Basin) which the companies are developing

together. The stock jumped roughly 30% to a new 52-week high. Good news should

continue, for this project and the industry as a whole.

© theinvestar.com, LLC - read disclaimer

|

|