Archives Page

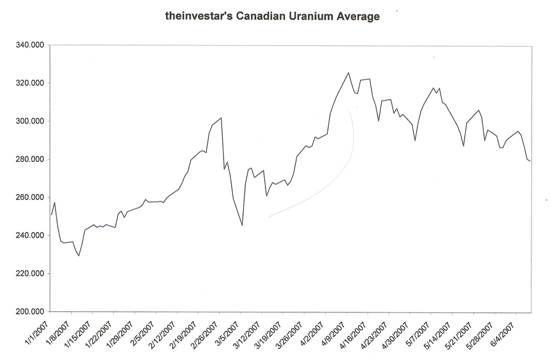

Some Recent News We have had a lot of news lately, some of which has been big, while the rest has been somewhat ignored. First and foremost we had SXR agree to purchase Energy Metals Corp. (EMC) in an all stock deal. This further establishes SXR as THE legitimate alternative to Cameco for funds (mutual, hedge, etc.) to invest their money in. It will be valued at roughly $7 Billion, will most likely take over Energy Metals' listing on the NYSE/Arca where shares trade under the symbol of EMU. The company currently has production of U3O8 as a result of its Urasia purchase earlier this year, and just opened up the Dominion Project in South Africa, with Honeymoon to soon follow out of Australia. The company is unhedged, so they will be able to present investors with a more compelling growth story than Cameco over the next few years. Recently we spoke to a high ranking executive with a leading uranium company who is still amazed that Cameco has not become more active. Many within the industry have their doubts for how much longer Cameco can hold out before making new investments in the industry. This is something that we should pay attention to in the future, as it will indicate that the flood gates are beginning to open (no pun intended here). When Cameco begins to invest more freely, there is reason to believe that utilities will begin to purchase physical U3O8 with less regard for price. When the largest pure-play supplier in the industry begins to buy up more supply, it is indicative of the belief that there will be a tight market for years to come and could push the utilities into the markets. We have not added any new stocks to our portfolio lately as we had been waiting to see cheaper prices, as was indicated as highly likely by -theinvestar's Canadian Uranium Average. After yesterday it appears very likely that we could go lower in the future as we finally broke through the support levels established throughout the year, and what is more it was more than 1% below the previous low. Also of interest would be that U.S. markets are cooling off, which could force some investors to take money off the table here and around the world. This is already taking place as Australia is experiencing a sell-off in its equity markets as a result of New Zealand's surprise rate increase to the 8% level.

Although our portfolio positions are all still intact as we have not sold any positions, our cash position has grown to a very large portion of the portfolio due to our regular contributions. Although we believe that many uranium stocks will retreat in the months ahead, we see some very intriguing plays which we cannot hold out on much longer. One such stock is Mawson Resources (MAW) C$1.91 which at current prices has about C$.41 to the downside, but potentially C$1 to the upside in the next few weeks. If the company can prove up the lbs. they think they have of U3O8, then the stock is currently trading at a ridiculous discount. So we have added MAW at C$1.91, and shall hold whether the stock goes lower or moves upward. Should the stock move lower, we will nimble all the way down and become very aggressive as it approaches C$1.50. One of our reasons for purchasing Canadian uraniums was that we truly believed that the Canadian Dollar, as well as the Australian Dollar, was undervalued as compared to the U.S. Dollar. The Canadian Dollar has risen dramatically over the past month or so and is now at around US$.94 per C$1, which is up considerably since we proposed the idea of the 'hidden appreciation' potential of these stocks, or our 'kicker'. Then the C$ was at around C$1 per US$.89, so we have seen a 5.6% rise in value of our stocks not indicated by their closing price for those making their purchases in US$. We said earlier that we thought the two could trade on par, and stand by that, however we do believe that a breather is needed and could happen sooner rather than later. If the US raises rates, as the markets believe will happen (although they still are not aware of the reason-inflation or growth), that could halt the C$'s run. Another story of interest, which went unnoticed by many in the marketplace, was Santoy's news release regarding their drilling operations in Labrador's Central Mineral Belt. The drilling was a success and confirmed a uranium mineralized zone on the company's 100% owned Fish Hawk Lake property. The company drilled 15 holes (via diamond) and hit some form of U3O8 mineralization in each one. In the South Zone, they hit significant values of U3O8 in 10 of 13 holes which we were told in many cases did not exceed 50 m depth. Many of the holes remain open at depth, and the company has realized that this area of the CMB may hold “blind” deposits, those which do not show up on airborne radiometrics. Our only addition at this time is Mawson (MAW) and we will

continue to add on weakness. We are waiting for further declines in the sector

before buying some of our other targets, and will notify you once we do begin to

make those purchases.

© theinvestar.com, LLC - read disclaimer

|

|